Terraform Industries’ Business Case Doesn’t Add Up

In the arena of cleantech startups with big aspirations, Terraform Industries is undoubtedly one of the more fascinating and ambitious players. Terraform plans to produce gigatons of synthetic natural gas from “sunlight and air” and displace the legacy fossil-based hydcrocarbon supply chain in the process. Its first product will be the “Terraformer Mark One” which is intended as a drop-in replacement for depleted oil wells. The company envisions the eventual deployment of millions of “self-funding” terraformers to achieve a fossil-free future.

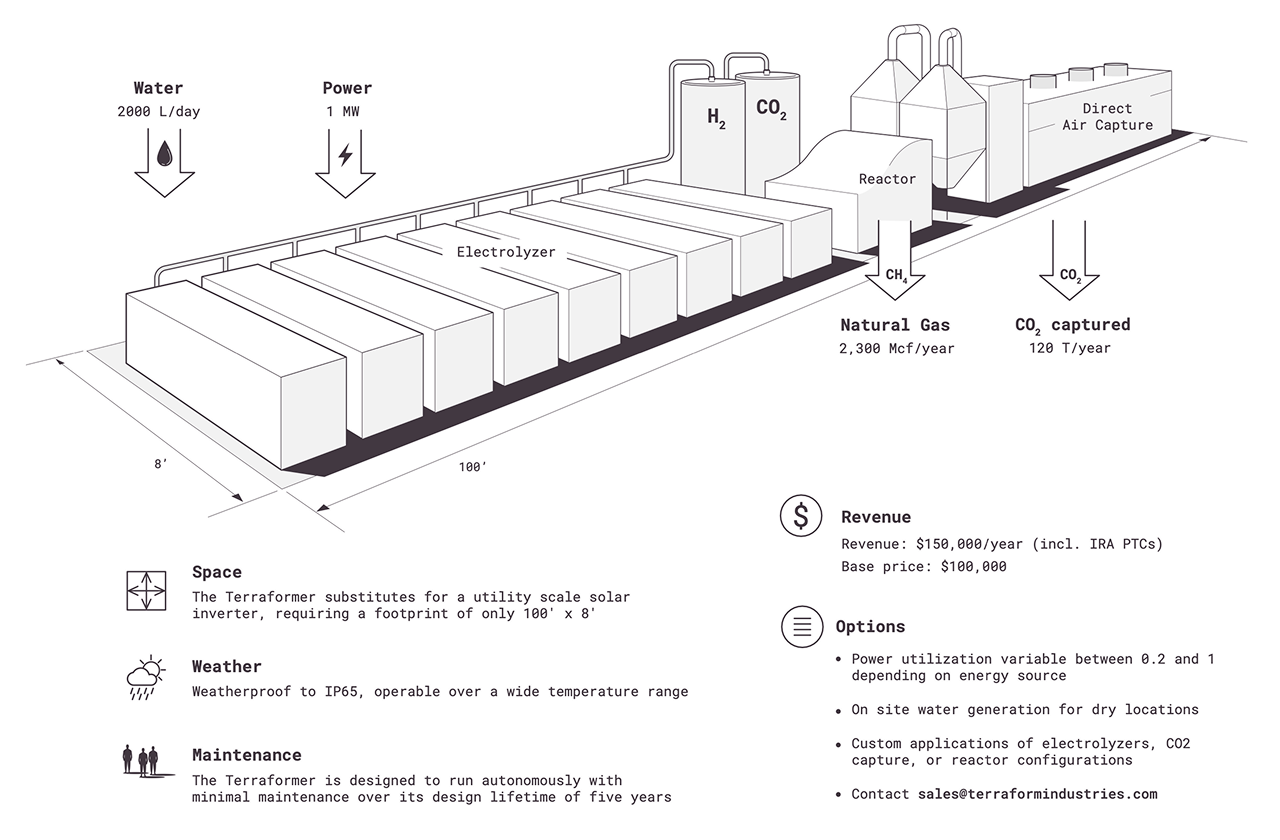

The Terraformer Mark One (© Terraform Industries)

The Terraformer Mark One (© Terraform Industries)

To state the obvious: I wish Terraform will succeed in its mission. We have roughly 25 years left to solve the climate crisis and still obtain about 80% of global primary energy from oil, coal and (traditional) gas. Any even remotely promising pathway to rid ourselves of this addiction is worth pursuing.

Terraform’s founder, Casey Handmer, is an exceptional polymath, scientist, space nerd and engineer, and also a prolific writer and public speaker, able to articulate a positive vision for humanity with unparalleled clarity. Casey’s article “We Will Build Our Way Out of the Climate Crisis” was a personal wake-up call that got me seriously interested in cleantech over a year ago. The world which Casey predicts - one in which fossil fuel extraction is upended by cheaper, clean hydrocarbons and humanity lives in energy abundance - is a world I would like to live in. Casey seems to have a very clear plan how to get there. He has assembled a world-class team of engineers, raised 26m$ in funding to date and the company seems well underway to deploy its first Terraformer in 2025.

On its website, Terraform claims:

“As solar power gets cheaper, there will come a time when it is cheaper to get carbon from the atmosphere than an oil well. That time is now.”

Here’s the thing: I don’t think that’s true and without subsidies like the IRA it won’t be true for at least another 20 years. The arguments laid out by Casey in Terraform’s whitepaper, blog posts and podcast episodes are compelling and correct in principle, but the numbers don’t add up. I will point out the discrepancies in this blog post and hope reality will prove me wrong.

TL;DR:

Short amortization and decreasing OpEx are not possible when you have to build the required solar power yourself. Running one Terraformer will cost around 10x its base price amortized over 25 years. [Read why]

The logic behind using deliberately inefficient electrolyzers to achieve $1/kg green hydrogen is flawed. AEM electrolyzers are poised to produce equally cheap hydrogen in much larger quantities than Terraform’s system and thus provide better ROI. [Read why]

Terraform is basing its unit economics on an unrealistic $10/kcf natural gas price. For the foreseeable future, US natural gas will be available for $3-5/kcf and will slowly rise to $7-10/kcf until 2050. [Read why]

With its current specs and the non-negligible cost of the solar array, the Terraformer is a money-losing investment. The majority of its revenue comes from IRA tax credits, which will expire by 2032 at the latest. The unsubsidized revenue from gas offtake is insignificant and won’t pay back the invested money even after 25 years. [Read why]

I. The Cheap Solar / Amortization Fallacy

Photo by Manny Becerra on Unsplash

Photo by Manny Becerra on Unsplash

Terraform’s central premise is that cheap solar turns the traditional CapEx / OpEx balance on its head. Because electricity used to be expensive, industrial systems were historically designed to maximize efficiency and minimize OpEx. This warranted high CapEx (spending money on sophisticated R&D and expensive materials/parts) that was then amortized over 30-40 years. The advent of cheap solar changes this equation: When electricity gets cheaper 10-12% year-on-year, it makes sense to minimize CapEx and build deliberately inefficient systems that are highly sensitive to the cost of electricity. Casey calls this the “cheap and cheerful” approach: Customers buy a system that might have high OpEx today but becomes cheaper to operate every year. The lower upfront costs of these less sophisticated systems mean they can be amortized over short time spans, e.g. 5 years, and are thus able to economically compete with oil wells.

1: Terraform’s customers are intended to benefit from the continously decreasing cost of solar electricity, amortizing their investment in a Terraformer within about 5 years.

This promise is visible in the Terraformer specs (see “Power 1 MW” and “design lifetime” in the product image at the top), its whitepaper (“A 5 year equipment lifetime is plenty, as a short ROI is good for scale.”) as well as numerous comments from Casey (“We can pass those savings on to our customers because we’re sensitive to those costs.”, “We need an ROI measured in a couple of years at most […] We can’t afford to amortize over 20 or 30 years, we have to get the money out really quickly.” ).

To achieve low CapEx, Terraform eliminates any component that might ordinarily be included in a power-to-gas plant but is not strictly necessary in the context of intermittent solar. Specifically, on the solar side the Terraformer is powered directly by DC power from the panels, saving the cost and space normally needed for a utility-scale inverter. In fact, the Terraformer has been designed to substitute the inverter (see the image at the top). One of the huge benefits of the Terraformer is that it can be put in the middle of “the most worthless, useless land ever known” (as Casey puts it), so long as there is sunlight and air (which can also deliver the water needed for electrolysis) and a pipeline connection to offtake the gas. A grid connection is not necessary. This contributes positively to the overall business case as the cost of land basically becomes neglible.

2: The Terraformer is intended as a standalone system that is deployed on cheap land alongside a 1 MW solar array without an inverter or a grid connection.

If you carefully read statements 1 and 2 above you will notice that they contradict each other. You could

… either connect your Terraformer to the grid and benefit from the year-on-year drop in solar LCOE through dynamic pricing or short-term PPAs that can be re-negotiated every couple of years. In this scenario you will have to be in an area that’s serviced by a utility and where you will compete with other industrial players for renewable energy. The cost of land will be non-negligible and your project will be constrained by grid interconnection, permitting etc. This is not the type of deployment Terraform envisions.

… or you could put your Terraformer in the middle of nowhere, let’s say next to a depleted oil well. In this case, you will have to build the 1 MW solar array yourself and these costs become part of your Terraformer investment. Your LCOE is locked in for 25-30 years (the lifespan of your solar array) and you will not see the YoY improvements in price that were supposed to make the OpEx side of running a Terraformer attractive.

What I am saying is that you can’t have your cake and eat it, too. The Terraformer Mark One is marketed as though the 1 MW of solar power was just a peripheral commodity input (like water, air and sunlight) that will be available anywhere and get cheaper over time. In the remote rural areas where Terraformers are to be deployed, the reality is that building the required solar power is a fixed 25-30 year commitment that makes up the bulk of the financial burden. Let’s run some numbers for the US:

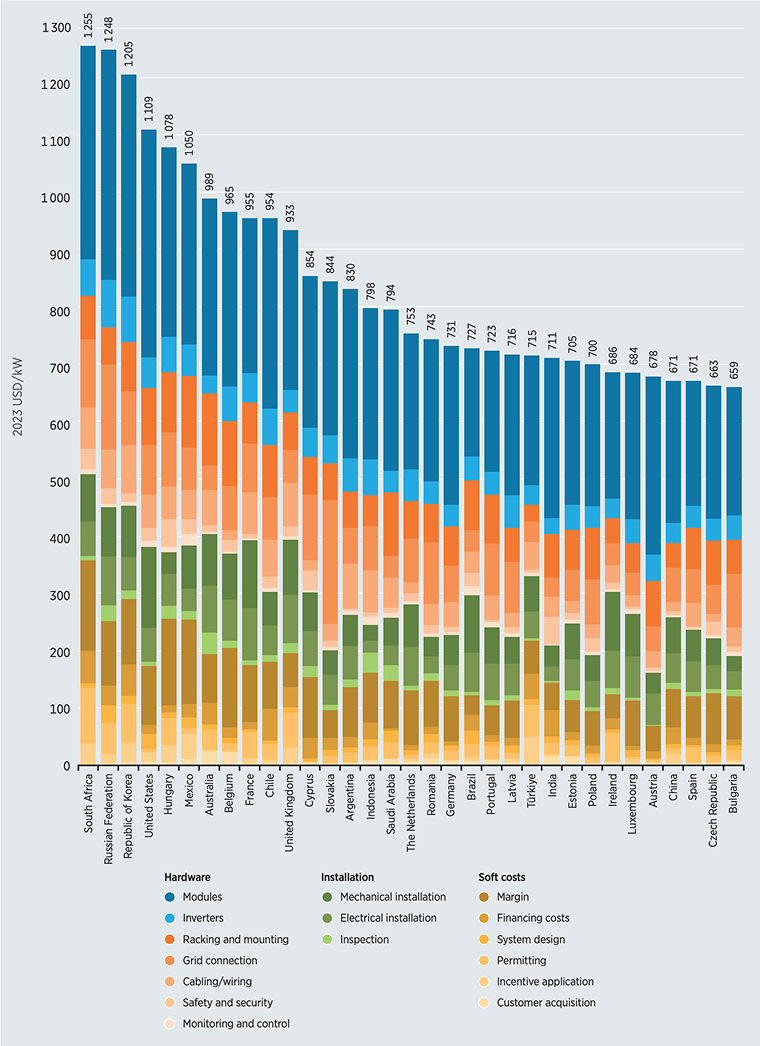

In 2025, building a solar array costs $0.80–$1.36 for every Wp of installed capacity (excluding the cost of land), so our 1 MW array comes out at $1,000,000, give or take. IRENA has a nice breakdown for utility-scale solar total installed costs:

Source: IRENA - Renewable Power Generation Costs in 2023

Source: IRENA - Renewable Power Generation Costs in 2023

The numbers are from 2023 but give us a good idea of the cost proportions. Let’s take out all costs that won’t be needed by the Terraformer:

- No inverter:

-4.9% - No grid connection:

-7.8% - Less safety and security (in the middle of nowhere, might not even need a fence):

-1.0% - No margin (we assume the work will be done at cost by Terraform contractors):

-9.3% - No system design costs (we assume the 1 MW array will be part of a standardized plant layout):

-2.3% - No permitting (private land, no grid connection):

-0.5% - No customer acquisition (the solar array is sold as part of the overall system):

-0.6%

Note: Some of these assumptions are optimistic, but we’ll make them anyway, in favor of Terraform’s business case.

The sum of savings is -26.4%, which means a 1 MW solar array for the Terraformer will - despite the aggressive reductions - still cost around three quarters of the regular utility-scale price, or about $736,000 in 2025. That is more than 7x the base price of the Terraformer.

But there’s more: The solar array will last 25-30 years, but your Terraformer has a design lifetime of only 5 years. So you can try to either amortize $836,000 (solar array + Terraformer) over 5 years or replace your Terraformer 4 times and amortize $1,236,000 (solar array + 5 Terraformers) over 25 years. Let’s assume Terraform has sensible plans for recycling and servicing existing plants, replacing only the worn-out parts (like the electrolyzer) and that it would do these “re-ups” as cost-effectively as possible at $50,000 per replacement. This would then work out to $1,036,000 over 25 years.

I think it’s fair to assume that no one in their right mind would choose the first option, as that would mean leaving a perfectly functional, fully paid-for 1 MW solar array with 20 years of remaining lifespan and no grid connection sitting idle in the middle of the desert. That leaves the second option and it effectively means that the decision to buy and operate one Terraformer is equivalent to spending north of $1m for a solar array, 1 Terraformer and 4 replacements, amortized over 25 years. During those 25 years you will not “get your money out quickly” and you will also not get to enjoy the benefits of falling OpEx, as you locked in the LCOE when you bought your solar panels.

The Terraformer’s advertised base price of $100k amortized over 5 years is a red herring. To operate one Terraformer on cheap, off-grid land you will have to spend around 10x its base price amortized over 25 years and will not profit from the falling LCOE of solar power.

Questions

Terraform’s target LCOE is $10/MWh. Is that achievable?

Let’s run the numbers with the 2025 costs for the 1 MW solar array outlined above. Remember we ripped out the inverter and any balance-of-system costs not necessary for operating the Terraformer and came out at $736,000 amortized over 25 years. How much energy would this system deliver in sunny California where Terraform is based and plans to deploy the first units? The Global Solar Atlas gives us a specific photovoltaic power output (PVOUT) of 1,853.5 kWh/kWp per year for California. Over 25 years our invest will thus yield a total of 46,337.5 MWh, which works out to an LCOE of 15.88 $/MWh today. Pretty good.

Because of ongoing overproduction in China, the cost of solar panels is forecast to drop by another 50% until 2030. In the US, the panels make up 35.8% of total cost, so we will cut their share down to 17.9%. In 2030 the average 1 MW solar array would then cost $579,000, yielding a 2030 LCOE of $12.50 in California. If we go to the absolute lowest end of 2025 solar array costs and assume $0.80 for every Wp installed, this projection gives us a 1 MW array cost of $463,200 and an LCOE of $9.99! So, yeah - $10 is possible, though in most regions the 2030 LCOE will be higher.

What if solar panels were free?

This is an interesting thought experiment. If the price of solar panels went to zero, what would utility-scale solar electricity cost? Looking at the IRENA breakdown above, we could completely eliminate the top blue portion (35.8%). We would still be left with costs for human labor and other materials (racking and mounting, cabling/wiring, mechanical installation, electrical installation etc.) which add up to 40% of today’s total. Assuming these could also be squeezed further (by partially automating installation etc.) we could maybe get down to 30%. So a theoretical lower limit for our bare-bones 1 MW solar array (no inverter, no balance-of-system etc.), with zero-cost panels and some installation still required would come out at $240,000, which in California would correspond to a phenomenal LCOE of 5.18 $/MWh. It’s interesting to realize that, while both sunlight and panels would be free of charge, you would still have to pay half a cent for every kWh, just because someone needs to put the panels in place and maintain them.

II. The Electrolyzer Fallacy

Photo by ITM Power Plc on Wikipedia

Photo by ITM Power Plc on Wikipedia

Terraform’s deliberately inefficient electrolyzer may be one of most interesting things to wrap your head around. As detailed in their blog post “How to Produce Green Hydrogen for $1/kg”, the intermittency of cheap diurnal DC solar power creates an unexpected economical sweet spot for electrolyzers with low efficiency and low CapEx that run only when the sun is shining. This is in contrast to the established, high-CapEx alkaline, PEM or solid oxide electrolyzers that are built for 100% utilization and achieve close-to-optimal efficiency.

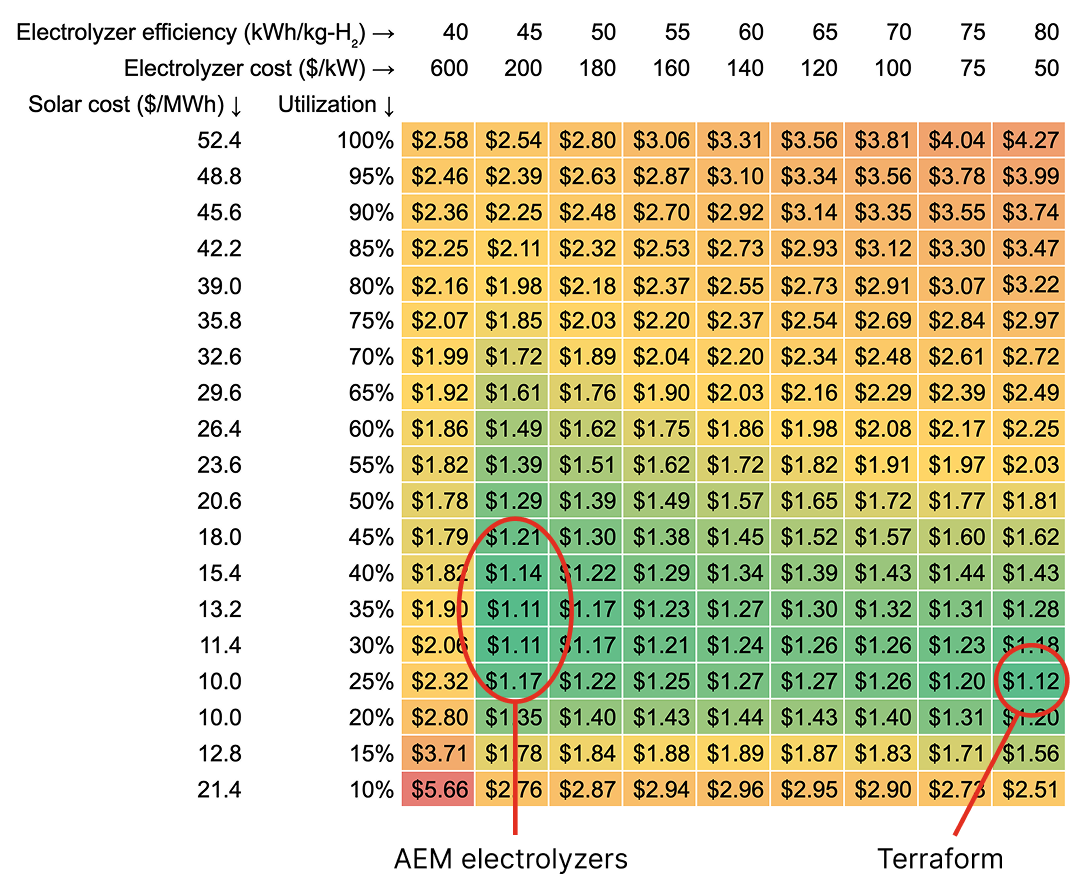

To understand how this can be possible, let’s recap two examples from the whitepaper. First, we need a hypothesis about how solar LCOE and utilization depend on each other and how much solar power will cost in the future. Casey’s take is that “direct-from-the-panel” DC power is around 20 $/MWh today, but within a few years time could be as low as 10 $/MWh. His optimistic forecast for battery-buffered (or load-shifted) solar power in the not-too-distant future is 45 $/MWh. 2028 seems a bit optimistic to me, but I generally agree with these numbers and think for 2030 they are well within reach. Now for the examples:

We’ll run a top-of-the-line ( = 1,000 $/kW), highly efficient ( = 50 kWh/kg‑H₂) electrolyzer round the clock ( = 100%) on the most favoribly-priced battery-buffered 2030 solar power ( = 0.045 $/kWh) and amortize our investment over = 50,000 hours (5.7 years). This works out to OpEx = = 2.25 $/kg‑H₂ and CapEx = = 1.00 $/kg‑H₂ for a total of $3.25 per kg‑H₂. Not great.

We’ll feed our low-CapEx ( = 100 $/kW), inefficent ( = 80 kWh/kg‑H₂) electrolyzer cheap DC solar power straight from the panel (at = 0.02 $/kWh). The electrolyzer will only run for 6 hours during the day ( = 25%), amortized over the same = 50,000 hours. This works out to OpEx = 1.60 $/kg‑H₂ and CapEx = 0.64 $/kg‑H₂ for a total price of $2.24 per kg of H₂. Not bad. Now, assuming solar costs will reach 10 $/MWh ( = 0.01 $/kWh) and electrolyzer costs would improve to 50 $/kW, we could end up with $1.12 per kg-H₂ by 2030, pretty close to the mythical $1-threshold. Nice.

It seems like the low efficiency approach of Terraform is a clear winner, right? Well, not quite.

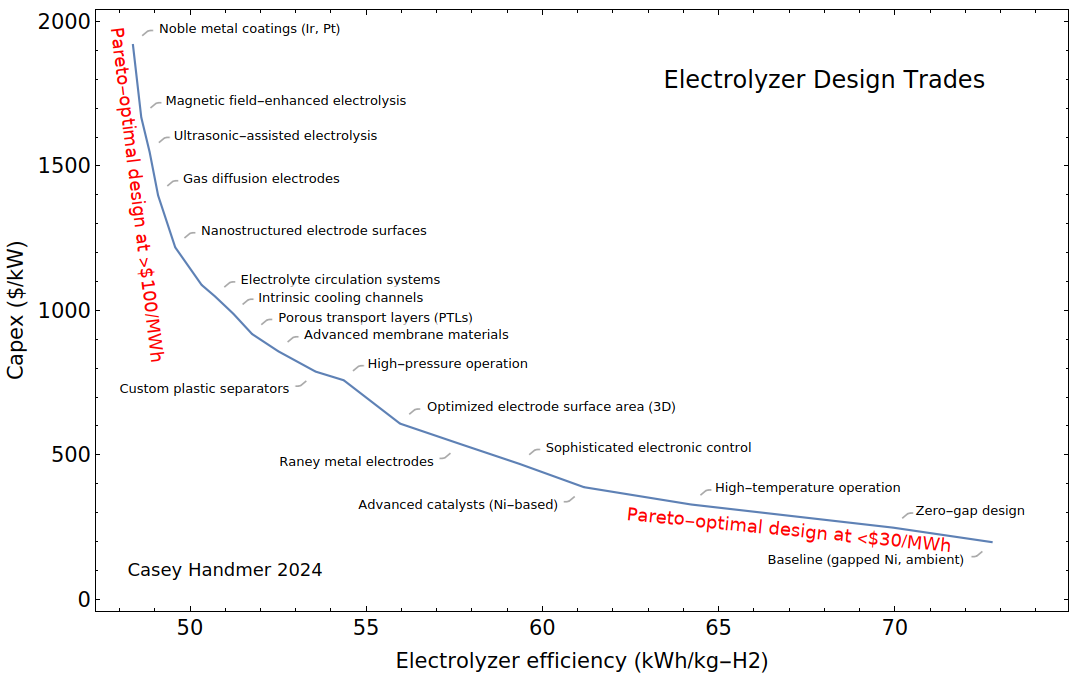

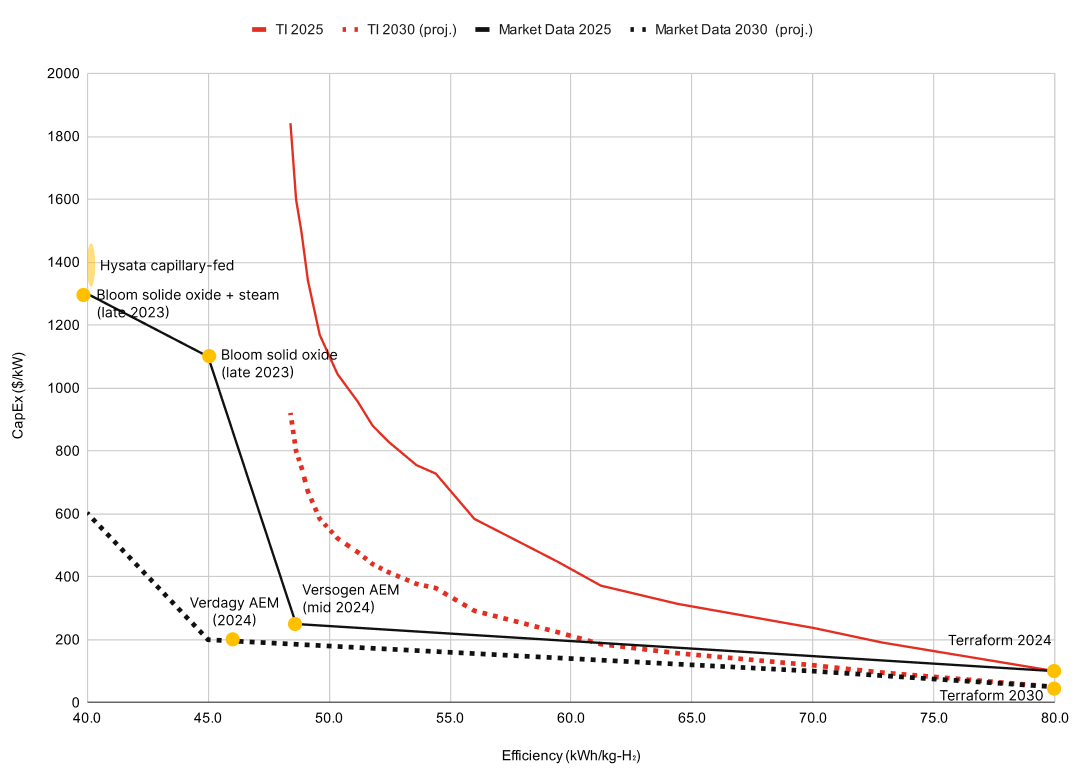

Just like for solar LCOE, we need an opinion about how electrolyzer costs and efficiencies depend on each other and where they will go over the next years. Casey has developed a detailed hypothesis based on the technologies and materials involved:

Terraform’s take on electrolyzer pricing (© Casey Handmer, Terraform Industries)

Terraform’s take on electrolyzer pricing (© Casey Handmer, Terraform Industries)

While I am certain that his first-principles deduction is thorough, market data from 2022-2024 seems to suggest a somewhat different picture:

Bloom Energy, the company that claims to make “The world’s most efficient electrolyzer” had a price range of 1,100-1,300 $/kW for its solid oxide electrolyzer in late 2023 with an efficiency of 45 kWh/kg-H₂ (or an insane 39.6 kWh/kg-H₂ when using steam) and a claimed YoY cost improvement of 12%.

Hysata, another big player in the electrolyzer space, achieved 41.5 kWh/kg-H₂ stack efficiency in 2022. While no specific CapEx numbers have been published, they compete in the same segment as Bloom Energy, so I would place them in the ~1,300 $/kW range in 2024, with similar expected cost reductions.

What I am saying is that in 2025 and at a price point of ~1,000 $/kW, commercially available high-end electrolyzers are already incredibly close to the theoretical limit of 39.4 kWh (the higher heating value of 1 kg of H₂) and we’ll see the cost go way below 1,000 $/kW in the coming years.

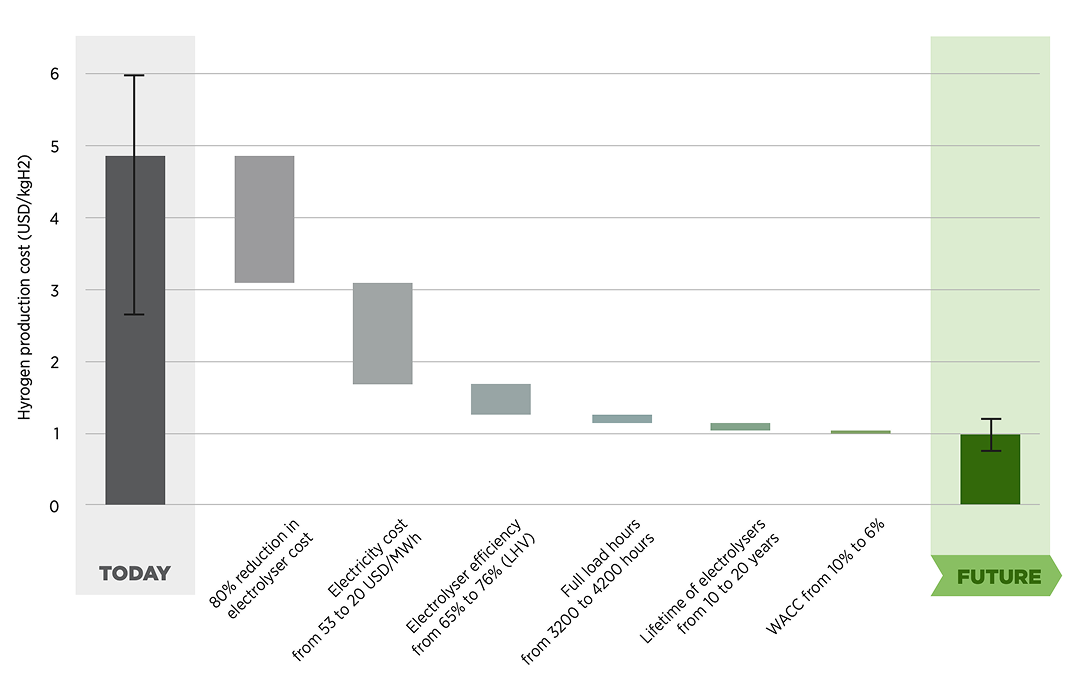

How far could the cost come down? In its 2020 report on green hydrogen, IRENA detailed the cost reduction potential for electrolyzers:

Source: IRENA - Green Hydrogen Cost Reduction

Source: IRENA - Green Hydrogen Cost Reduction

Note the possible 80% reduction in direct costs as well as the increase in full load hours and lifetime. We don’t know how long it will take exactly, but with the ongoing global electrolyzer arms race and the learning rate / feedback cycle that will accelerate further as demand increases, it wouldn’t be unreasonable to assume we’ll have electrolyzers with near-optimal efficiencies (≤ 40 kWh/kg-H₂) for less than 600 $/kW by 2030.

What’s more is that companies like Versogen, Verdagy, Enapter and many more are developing a new class of “less CapEx, less OpEx” anion-exchange membrane electrolyzers with efficiencies of 45-50 kWh/kg-H₂ for 200-250 $/kW. Some data points:

Versogen claimed 48.6 kWh/kg-H₂ for 250 $/kW for its AEM electrolyzer in June 2024. I am not sure whether this system is commercially available at scale but it gives us a good reference data point.

California-based Verdagy announced a production CapEx below 200 $/kW in 2022 already, with a stack efficiency of 41-51 kWh/kg-H₂ (which is a pretty broad range - we’ll use the 46 kWh/kg-H₂ mid point). Gigawatt-scale production started in October 2024.

These systems are several percent more efficient and 4 times cheaper than what Terraform was assuming in their blog post. Let’s overlay Casey’s graph with the market-based assumptions:

The red line (TI) is Terraform Industries’ hypothesis. The dotted red line extrapolates that hypothesis to 2030 by assuming a 12% YoY cost reduction, which is in line with Casey’s statement that Terraformer’s electrolyzer could improve CapEx by 50% within a few years. The black line is the hypothesis based on (sparse) publicly available market data. Again, the dotted black line extrapolates this using a 12% YoY cost reduction, except for AEM electrolyzers, where we conservatively assume that it will take until 2030 to reach 200 $/kW and 45 kWh/kg-H₂. This should give us a pretty fair comparison.

OK, so what would 2030 green hydrogen prices look like in this landscape?

Per-kg H₂ prices for solar LCOE / utilization according to Terraform and electrolyzer costs / efficiencies based on extrapolated market data.

Per-kg H₂ prices for solar LCOE / utilization according to Terraform and electrolyzer costs / efficiencies based on extrapolated market data.

This is interesting. Terraform has definitely claimed the “cheap and cheerful” sweet spot at the bottom right. But apparently there’s another attractive region for electrolyzers with high efficiency, relatively low CapEx and a utilization between 25-50%. This might be why AEM electrolyzer makers like Enapter are starting to integrate battery storage into their plant or why Verdagy’s system will handle flexible power supply from solar, wind and batteries.

Why do we care? Does it even matter? If both approaches produce hydrogen at around $1.12 per kg, wouldn’t Terraform’s approach still be preferable because it doesn’t need batteries, energy management logic etc.? Well, no - because while the price per kg may be the same, the AEM electrolyzers will produce much more hydrogen! Running Terraform’s hypothetical 1 MW electrolyzer for 12,500 hours (25% of 50,000 hours) will produce 12,500,000 kWh / 80 kWh/kg-H₂ = 156,250 kg-H₂ over its lifespan (as noted in their blog post). Running a 1 MW AEM electrolyzer with = 200 $/kW and = 45 kWh/kg‑H₂ for 17,500 hours (35% of 50,000 hours) will yield 388,888 kg-H₂, which is almost 2.5 times as much. For $1.11 per kg.

What this means is that Terraform’s central mantra “Low electrical efficiency is good.” is bogus. “Low CapEx is good.” - I think we can all agree on that. Once you manage to get CapEx “low enough” through technological innovation you still want high electrical efficiency in order to produce as much cheap hydrogen as possible. I think Terraform is currently sitting on the wrong end of this equation and will either have to up its electrolyzer game to achieve significantly higher efficiencies or simply buy their electrolyzer from companies like Verdagy. They could also aim to push down the cost further, although quality and lifespan constraints probably impose a hard floor on this.

Terraform’s argument that deliberately inefficient electrolyzers run with raw solar power at 25% utilization are the best pathway to $1/kg green hydrogen is flawed. Highly efficient AEM electrolyzers at around 35% utilization are poised to produce greater quantities of H₂ at the same price and will thus have significantly better ROI.

Questions

Why 50,000 hours of amortization?

This is the typical lifespan of utility-scale electrolyzers today. Also, Terraform is trying to compete with investments in oil wells, where the amortization period is 60 months (5 years). As pointed out above this may be unrealistic, especially when you have to build out the required renewable energy as part of the project. As the lifespans of electrolyzers will increase to 10 and eventually 20 years, the financing will adapt to these lifecycles, which further discourages the “cheap and cheerful” approach.

Aren’t all of these prices too optimistic?

Yes. The entire discussion above, including Terraform’s numbers, considers stack efficiency (how efficient the electrolyzer stack is), not system efficiency (how efficient the overall system will be). It deliberately ignores balance-of-plant costs, water costs, financing costs etc. In 2030, unsubsidized green hydrogen prices will likely be around the 1.50 $/kg mark. However, this doesn’t affect the validity of the overall analysis and the conclusion we can draw from it.

Is this bad for Terraform Industries?

Not necessarily, no. The fact that there is another cost/efficiency/utilization region that can deliver more green hydrogen at attractive prices is good for everyone in the space. Terraform may have to revisit its assumptions and decide if this changes the unit economics and/or design considerations for the Terraformer.

Terraform’s electrolyzer is built from cheap materials and specifically for intermittent operation. Isn’t that a competetive advantage?

By now, all major players in the electrolyzer space are designing their systems for frequent ramp up / ramp down to play nice with intermittent sources of energy. While high-end models still have some dependency on rare-earth metals, AEM electrolyzers use abundant and less costly transition metals (nickel, nickel-iron alloys, sometimes cobalt). So no, I don’t think these design considerations set Terraform apart from the competition.

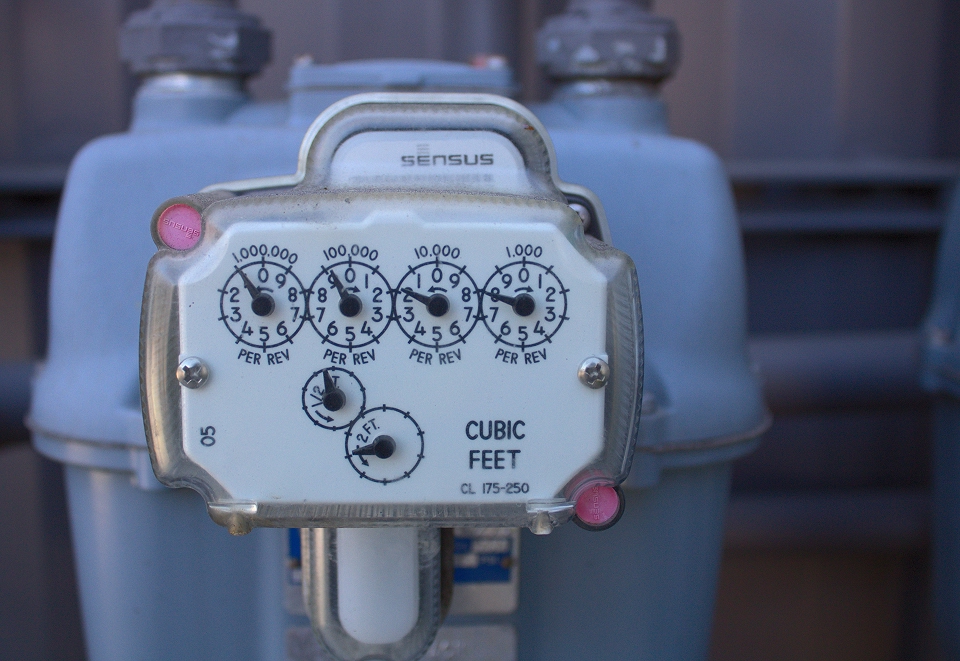

III. The Gas Price Fallacy

Photo by Doris Morgan on Unsplash

Photo by Doris Morgan on Unsplash

This part is the most puzzling to me. I cannot, for the life of me, figure out why Terraform is assuming natural gas prices of $10/kcf and is doubling down on this when asked about them. In the Terraform Industries Whitepaper 2.0 they claim:

“These credits […] enable TI to reach cost parity with Henry Hub natural gas prices (~$8.80/kcf) as soon as we hit production […]”

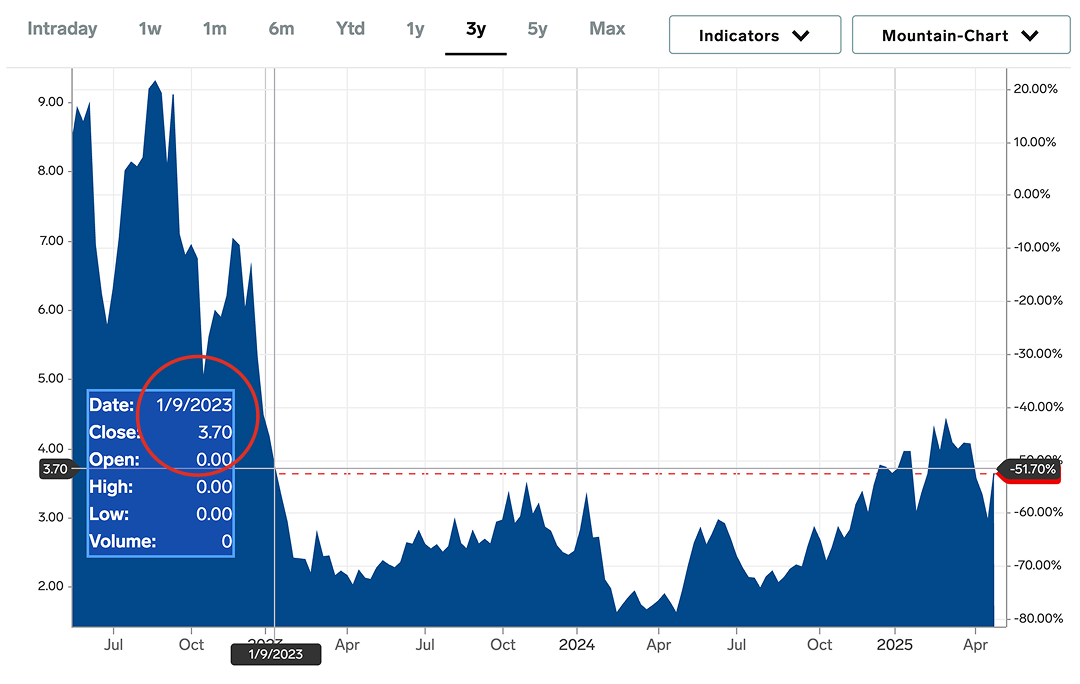

The whitepaper was published on 9 Jan 2023. Here’s the Henry Hub natural gas price in $/MMBtu for that day:

Source: Markets Insider

Source: Markets Insider

$3.70/MMBtu is $3.56/kcf, in case you’re wondering. Where did the $8.80/kcf come from? I think what may have happened here is that Casey had been preparing the whitepaper for some time, maybe as early as August 2022, when the US gas price was briefly above $9/MMBtu. This was 6 months after the Russian invasion of Ukraine and across the globe gas prices had spiked for some months, so a permanent climb to >$9/MMBtu may have seemed plausible at the time. The thing is: The natural gas price has since returned to its “normal” equilibrium of around $3/MMBtu and hasn’t crossed $4.50/MMBtu ever since. Yet, when Terraform published its Terraformer Mark One product announcement on 26 Jun 2023, it boldly stated:

“At $10/Mcf sale price […] each unit produces up to $150,000 of annual revenue.”

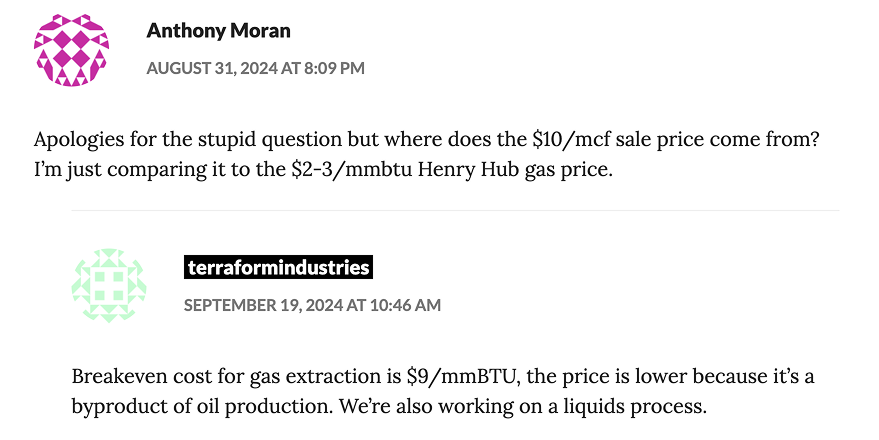

Sidenote for confused Europeans (like me): The “M” in “Mcf” stands for 1,000 (not “Mega” as in “MWh”) so it’s the same as kilo cubic feet (kcf). In June 2023 the Henry Hub natural gas price was around $2.70/MMBtu or $2.60/kcf. Where on earth did this expected sale price come from? A keen reader noticed the discrepancy as well and asked about it in the comments. This was Terraform’s answer:

Source: Comment on the Terraformer Mark One blog announcement

Source: Comment on the Terraformer Mark One blog announcement

Aha! Apparently Terraform had run some deeper analysis on the economics of natural gas extraction and based their $10 target on the conclusion that it will soon(?) be unprofitable to sell natural gas below $9/MMBtu. I guess the two questions to answer then are a) “Is this true?” and b) “How soon?“.

Is the breakeven price for gas extraction $9/MMBtu?

The short answer: No. Casey’s argument that “the [Henry Hub] price is lower because [natural gas] is a byproduct of oil production” is a weird way of deflecting the price question. Buyers in the gas market don’t really care whether the gas was extracted from natural reservoirs, through fracking or as a byproduct of drilling for oil. The only relevant question is at which prices it can be bought and whether/how that will change in the coming decades. Associated gas (gained as a byproduct of oil extraction) makes up about 16% of overall US natural gas production and the interesting thing is that for many oil wells in the US the breakeven price of associated natural gas is actually negative. You read that right: Well operators in some US regions will pay you to take their natural gas because they would otherwise have to flare it and pay royalties on “avoidably lost gas”. In other regions, the breakeven price for associated gas is usually around 2-3$/kcf.

Will the share of associated gas decline in the coming years? The 2025 Oil and Gas Industry Outlook by Deloitte doesn’t convey that impression (emphasis mine):

“Relative strength in crude oil prices […] has incentivized leading operators in the Permian basin to prioritize oil operations, resulting in an abundance of associated natural gas production. Additionally, large shale operators are exploring tier 2 and tier 3 acreage—which are generally much more gas-heavy—to help offset flattening production from their tier 1 acreage, unlock invested capital, and test new productivity and cost-efficiency measures. The result: The Permian Basin’s natural gas production has nearly doubled to 25 billion cubic feet per day (Bcf/d) in the last five years.”

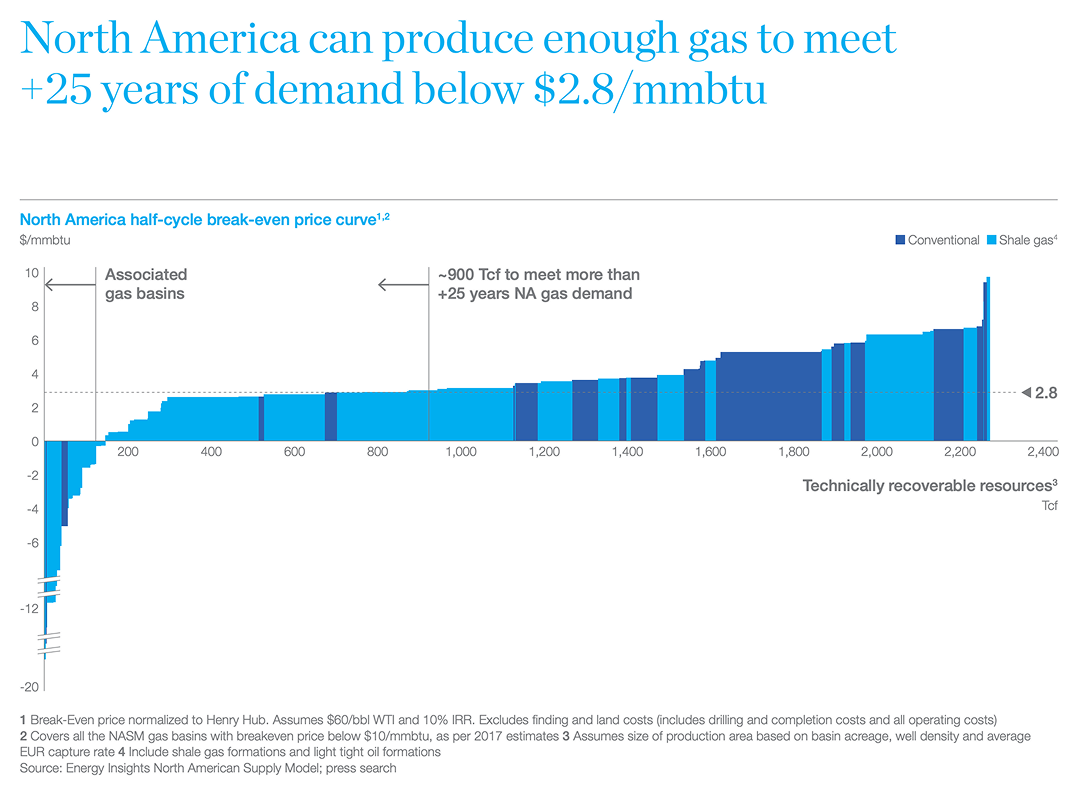

But Casey obviously has a point: Most of the US basins will reach peak production in the coming years (or have already done so) and the remaining “recoverable resources” are harder and harder to get too, increasing the breakeven price. McKinsey did a detailed analysis of the available North American gas resources in 2018. Here is what they found:

Source: McKinsey Energy Insights, North American Gas Perspectives

Source: McKinsey Energy Insights, North American Gas Perspectives

It looks like even though natural gas is becoming harder to extract, the US still has at least another 10-15 years with very moderate breakeven prices around $3/MMBtu ($2.89/kcf).

How long will it take for the gas price to reach $10/kcf?

Maybe McKinsey was too optimistic in its assessment of available resources. Also, we don’t really care about the breakeven analysis, we just want a somewhat realistic forecast of where the natural gas price (including margin) will go until 2050. If Terraform’s target price is $10/kcf, how long would it take to get there? Let’s look at some expert forecasts on the topic. One of the most comprehensive reports is the “Global Gas Outlook 2050” from the Gas Exporting Countries Forum (GECF), published in March 2024. It states:

“Accordingly, it is expected that the average long-term price for natural gas in Europe is set to stabilise at around USD 9/mmbtu, while in Asia, the long-term price is anticipated to settle at approximately USD 10/mmbtu. Meanwhile, the Henry Hub, which serves as a benchmark, is forecasted to maintain an average long-term natural gas price of about USD 4/mmbtu throughout the projected period.“,

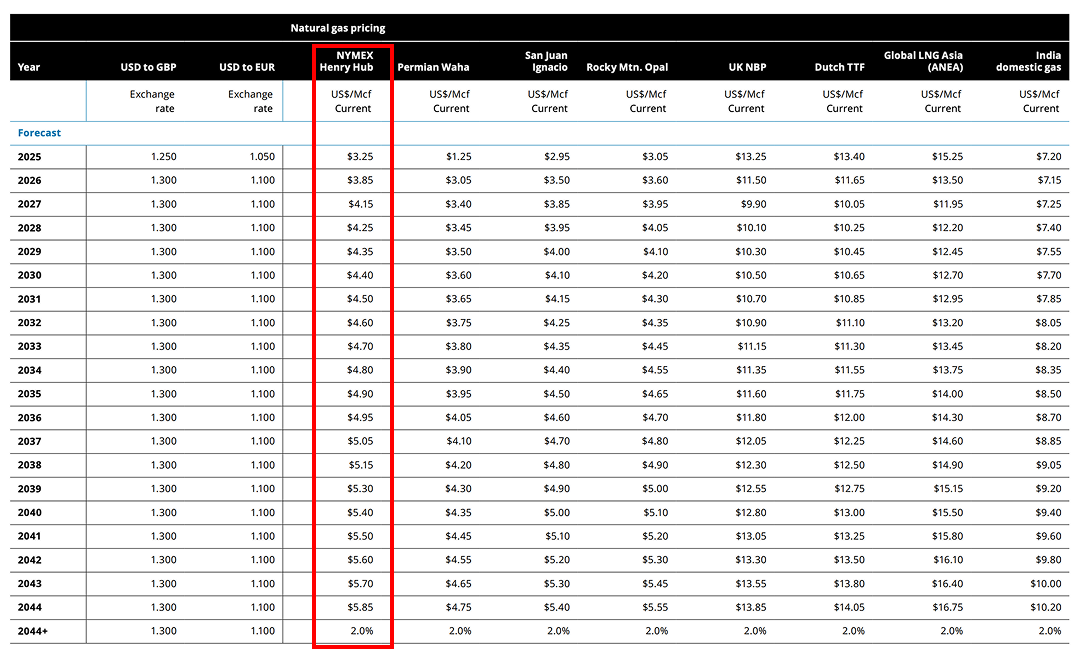

Note that “long-term” refers to 2050 in this report. Hmm, while the analysis seems thorough and considers lots of geographic and economic influence factors, it still sounds very optimistic. The report comes from the gas exporting countries after all, which might have an intrinsic motivation to predict attractive future gas prices. How about others? Deloitte (hello, again) did a thorough analysis of North American oil and gas rigs and published a detailed international price forecast in December 2024.

Source: Deloitte - Energy, oil, and gas forecast

Source: Deloitte - Energy, oil, and gas forecast

They forecast the Henry Hub natural gas price to approach $6/kcf by 2044 with an annual growth rate of 2% after that. This would mean that in 2050 we still wouldn’t have reached $7/kcf, while in Europe natural gas would cost around $15/kcf and in Asia around $11.50/kcf. I could cite more reports, but I think you get the general idea: It is rather unlikely that we will see US natural gas prices above $10/kcf before 2050. Of course geo-political conflicts or energy trade wars could cause temporary periods with spiking prices, but from a pure supply side point of view, US natural gas prices are likely to stay low and increase very gradually over the next two decades.

Why does it matter? The oil and gas industry is a ~$4tn/yr behemoth that has a decades-long history of lobbying and delaying defossilization efforts. While their resources are slowly depleting and there are early signs they might be leaving the battlefield for good, oil and gas companies will not go down without a fight. Terraform’s plan is to compete with the gas industry head-on, by selling competitively priced synthetic methane. To do that, I think it is important to have a 100% realistic view of future gas price development. My current impression is that Terraform is operating with a false baseline assumption and an expectation of future gas prices that is not grounded in market reality.

Terraform’s assumption of a $10/kcf sale price for natural gas in the US is disconnected from reality. For the foreseeable future, US natural gas will be available for $3-5/kcf and will slowly rise to $7-10/kcf until 2050.

IV. The Business Case

Photo by StellrWeb on Unsplash

Photo by StellrWeb on Unsplash

Let’s zoom out from the specific issues discussed above and look at Terraform’s overall value proposition. The Terraformer Mark One product announcement clearly outlines the - supposedly profitable - unit economics of the Terraformer:

“The Terraformer is designed to integrate directly with a standard 1 MW solar array. No grid connection, no interconnection queue. […] The Terraformer produces 1000 cubic feet of natural gas per hour of operation. It is optimized for 25% utilization, typical for utility scale solar arrays, and in this configuration produces 6000 cubic feet/day. Operating the equivalent of 2190 hours per year, one Terraformer produces over 2 million cubic feet of natural gas. At $10/Mcf sale price and $54/Mcf for IRA PTCs (45V, 45Q, 45E) each unit produces up to $150,000 of annual revenue.”

Two things are worth noting:

In their Whitepaper 2.0, published 5 months before, the Terraformer was still supposed to produce 6,500 cf per day “depending on capacity factor”. I’m not sure why the daily output estimate was reduced - maybe 6.5 kcf is only viable in sunny California, where utilization is at the upper end.

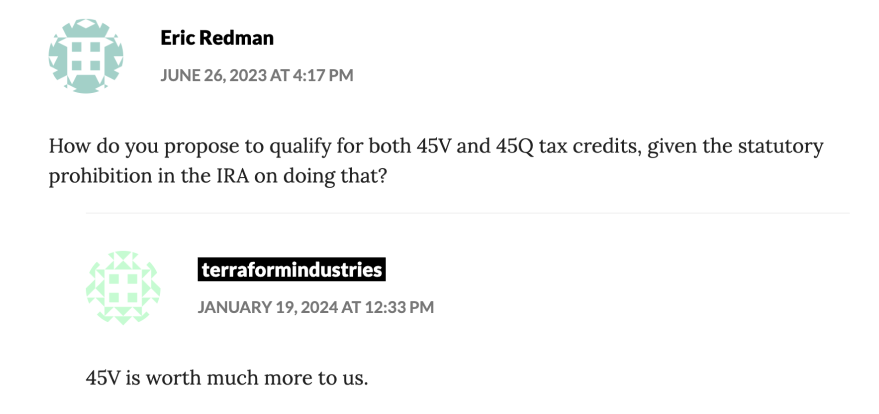

The announcement assumed that all three IRA production tax credits could be claimed (V = green hydrogen, Q = carbon capture, E = green electricity). This is not actually possible, as the IRA prohibits combining V and Q, which was again noted by an attentive blog reader and acknowledged by Terraform:

Source: Comment on the Terraformer Mark One blog announcement

Source: Comment on the Terraformer Mark One blog announcement

OK then, using 6 kcf/day and tax credits 45V and 45E, let’s look at the business case of investing in a Terraformer Mark One. The design lifetime of the Terraformer is 5 years, so our investment would be amortized over that period and we’ll use Terraform’s assumption of a $10/kcf gas price.

| 1 Terraformer (base price) | -$100,000 |

| 10,950 kcf of natural gas (5 years) | $109,500 |

| IRA 45V green hydrogen PTC (5 years) | $348,210 |

| IRA 45E green electricity PTC (5 years) | $147,825 |

| Total | $505,535 |

| Annual return | 43.4% |

Note that we come out at $101,107 annual revenue (not the claimed $150,000) because of the false assumption about the tax credits. But still, this seems like a pretty attractive business case. Invest $100k to make $500k in only 5 years? Sign me up!

Except that this is - as you will have guessed - not the full picture. First of all, as discussed above the $10/kcf price assumption for US natural gas is wishful thinking. A realistic (but still optimistic) gas price for the next decade would be $5/kcf, with which the Terraformer would generate a meager $54,750 in offtake revenue, roughly half its own base price.

Second, let’s take another look at Terraform’s elegantly worded description of where the solar power comes from:

“The Terraformer is designed to integrate directly with a standard 1 MW solar array.”

Great! Let’s just plug in our Terraformer and get star… oh wait, who puts that solar array in the middle of the desert? What do you mean, we don’t get it for free? Alright, let’s include the costs for a renewable power supply, then. The stripped-down solar array (no inverter, no balance-of-system costs, see above) runs us $736,000 and we’ll again amortize over 5 years and assume a wishful $10/kcf gas price:

| 1 Solar array (1 MW) | -$736,000 |

| 1 Terraformer (base price) | -$100,000 |

| 10,950 kcf of natural gas (5 years) | $109,500 |

| IRA 45V green hydrogen PTC (5 years) | $348,210 |

| IRA 45E green electricity PTC (5 years) | $147,825 |

| Total | -$230,465 |

| Annual return | -6.25% |

Yikes. With that pesky solar power CapEx we don’t seem to be able to make money despite the enormous subsidies involved. But Terraform is betting on the cost of solar coming down and the price of natural gas going up. Let’s fast forward to 2030 and make really optimistic assumptions about both: The 1 MW solar array will cost only $463,200 and natural gas will sell for … well, we’ll just stick with $10/kcf, because for 2030 that is still beyond optimistic.

| 1 Solar array (1 MW) | -$463,200 |

| 1 Terraformer (base price) | -$100,000 |

| 10,950 kcf of natural gas (5 years) | $109,500 |

| IRA 45V green hydrogen PTC (5 years) | $348,210 |

| IRA 45E green electricity PTC (5 years) | $147,825 |

| Total | $42,335 |

| Annual return | 1.46% |

That’s a tiny profit, but at ~1.5% annual return we’re not even beating inflation and remember that we haven’t included financing costs, maintenance etc. so in reality our Terraformer is not making money even when solar power is dirt cheap and natural gas is more expensive than anyone would dare to forecast for the 2030s.

It seems like there’s no way we can turn a profit with 5 years of amortization. That’s not necessarily a bad thing, because remember we just coughed up hundreds of thousands of dollars for a 1 MW solar array and left it sitting idle in the desert after 5 years. Maybe we’d rather use it for the entirety of its 25-year lifespan and buy 4 Terraformer replacements for a favorably priced $50,000 each. What would that work out to?

| 1 Solar array (1 MW) | -$463,200 |

| 1 Terraformer (base price) | -$100,000 |

| 4 Terraformer replacements | -$200,000 |

| 54,750 kcf of natural gas (25 years) | $547,500 |

| IRA 45V green hydrogen PTC (25 years) | $1,741,050 |

| IRA 45E green electricity PTC (25 years) | $739,125 |

| Total | $2,264,475 |

| Annual return | 5.67% |

There we go, decent profits! Except these are (still) based on an unrealistic $10/kcf gas price and - more importantly - on the assumption that we could pocket those IRA tax credits for 25 straight years. Which is impossible because a) IRA tax credit subsidies will end by 2032 and b) the IRA itself might get dismantled well before then by a climate-hostile US adminstration.

Let’s assume the IRA will survive until 2032 and we’ll deploy our Terraformer in Jan 2026 to enjoy 7 full years of subsidies:

| 1 Solar array (1 MW) | -$463,200 |

| 1 Terraformer (base price) | -$100,000 |

| 4 Terraformer replacements | -$200,000 |

| 54,750 kcf of natural gas (25 years) | $547,500 |

| IRA 45V green hydrogen PTC (7 years) | $487,494 |

| IRA 45E green electricity PTC (7 years) | $206,955 |

| Total | $478,749 |

| Annual return | 1.97% |

Hmm, we’re back to tiny returns (and still assume a wishful $10/kcf gas price as well the 2030 price for the solar array).

If you look at the numbers above, one thing stands out: A dramatically large portion of the Terraformer revenue is subsidies. Depending on the assumed gas price and amortization period, between 50-90% of revenue comes from IRA production tax credits. Without subsidies, the Terraformer (plus the needed solar array) does not even cover its own costs after 5 years. Even with the most favorable assumptions the Terraformer does not cover its own costs after 25 years. This seems like very shaky ground to build a scalable business model on.

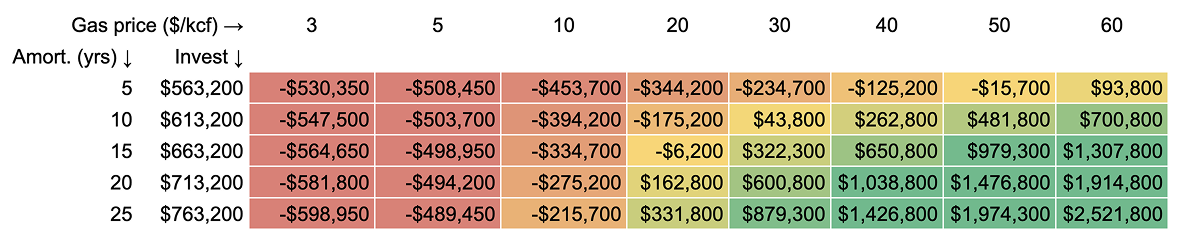

But surely there must be some point at which making synthetic natural gas will eventually be economical without subsidies? Let’s take out the tax credits and run some variations on the numbers. We’ll use one Terraformer and the cheapest possible solar array from above. For every additional 5 years beyond the design lifetime of the Terraformer we’ll add the cost of one replacement. At what gas price and amortization period does this constellation become profitable?

Profit/loss made after investing in a solar array, a Terraformer and Terraformer replacements (for longer amortization periods) when selling the produced natural gas at different market prices.

Profit/loss made after investing in a solar array, a Terraformer and Terraformer replacements (for longer amortization periods) when selling the produced natural gas at different market prices.

This does not bode well. Terraform’s dream of 5-year amortization would require natural gas prices around $60/kcf. I don’t know how expensive Terraform thinks natural gas will ultimately get, but with the announced specs, the Terraformer would only start to become a profitable investment if natural gas would permanently cost more than $20/kcf and we would be willing to amortize over at least 20 years. The gas price analysis above leads me to believe we won’t reach that point within a timeframe or scale that would have any meaningful impact on climate change. There may be some spots in Europe or Asia where these conditions will be met, but that’s a far cry from the gigascale global market potential that Terraform envisions.

Can this be fixed?

I don’t know. I can think of one factor that would improve the unit economics: Producing more methane. 6 kcf (about 170 m³) per day may sound like a lot, but in the world of gas trading it’s a drop in the bucket. Remember that natural gas production in the Permian basin alone is 25 billion cubic feet per day. Another way to view the investment is: We have covered 5 acres (2 hectares) of land with technological equipment worth hundreds of thousands of dollars to earn 30-60 unsubsidized dollars per day. That’s not great. If a Terraformer could produce more hydrogen (from which it could presumably make more methane without a huge increase of its land footprint), this would improve both the gas offtake revenue as well as the revenue from IRA 45V PTCs (while they last). Ironically, this means moving away from the “cheap and cheerful” approach and using a more efficient electrolyzer with higher CapEx, see above.

To illustrate this point, let’s do one last back-of-the-envelope calculation. We don’t know the exact energy split of the Terraformer components, but we do know that the electrolyzer eats the lion’s share of the available 1 MW. Let’s assume that 80% of the energy budget is consumed by the electrolyzer and that Terraform’s current electrolyzer is an 800 kW stack with an efficiency of = 80 kWh/kg‑H₂ and a price tag of $40,000. This would be in line with Terraform’s stated medium-term target CapEx of = 50 $/kW.

On a typical day and at 25% utilization, the electrolyzer uses 4,800 kWh of energy to produce 60 kg of H₂. This is then fed into the Sabatier reactor (along with air-captured CO₂) to obtain 6 kcf of natural gas, yielding the revenue discussed above.

Note: The H₂-input/CH₄-output relationship is probably wrong, as we don’t know a bunch of specifics around the losses and pressures involved. Fortunately, that doesn’t matter, as we’re just interested in a proportional comparison.

Now, suppose that instead of Terraform’s unit we had an 800 kW AEM electrolyzer with = 45 kWh/kg-H₂ and = 200 $/kW, which would cost $160,000 (four times as much). Similar to the Terraformer, we’ll assume that the lifespan is 5 years and that replacements can be done at half the cost ($80,000). The other Terraformer components also still need to be replaced (for $30,000), which brings the total cost of one replacement up to $110,000.

We’d like to run the AEM electrolyzer at 35% utilization (along with the other Terraformer components), so we need some extra solar panels and batteries. To keep it simple, we’ll just take the previously used 1 MW solar array cost ($463,200) and scale it up by 13.2/10.0 (which corresponds to Casey’s estimate of future solar LCOE at 35% vs 25% utilization). Our 1.4 MWp solar array with 2.4 h battery storage will then cost $611,424. Because the direct air capture unit and the Sabatier reactor will have to do a bit more work, too, we’ll round that up to $620,000.

On a typical day and at 35% utilization, the AEM electrolyzer uses 6,720 kWh of energy to produce 150 kg of H₂. Using the proportional relationship from above, the Sabatier reactor would produce roughly 15 kcf of natural gas.

What do the unit economics for the full 25 years look like in this scenario?

| 1 Solar array (1.4 MW) + battery storage (2.4 h) | -$620,000 |

| 1 Terraformer with AEM electrolyzer | -$220,000 |

| 4 replacements (AEM electrolyzer + Terraformer components) | -$440,000 |

| 136,875 kcf of natural gas (25 years) | $1,368,750 |

| IRA 45V green hydrogen PTC (7 years) | $1,218,735 |

| IRA 45E green electricity PTC (7 years) | $517,388 |

| Total | $1,824,873 |

| Annual return | 3.61% |

Even though CapEx is significantly higher (+$517,000), the business case turns out a lot better because we produce more hydrogen/methane and thus make more revenue from both gas offtake and subsidies. And unlike the original system, the enhanced Terraformer manages to pay for itself, albeit with small margins.

With its current specs, the Terraformer is a money-losing investment, because solar power is not free and natural gas is expected to be cheaply available for decades to come. It is a machine designed to primarily collect IRA tax credits, which will expire by 2032 (at the latest) and is not able to cover its own costs from natural gas offtake revenue.

Questions

Why is Terraform so hell-bent on 5 years of amortization?

I am not sure. I think they have grown very attached to the narrative of the Terraformer being a modular, revenue-generating machine that can be mass-manufactured and will deliver attractive returns in a short time span. Casey speaks of a “self-funding global fleet of 400 million Terraformers” in the product announcement. That is obviously more vision than reality at this point, as evidenced above, and - apart from signaling ambition - likely intended to create FOMO for potential investors.

What I don’t get is the talking point of having to “compete with oil wells”. There’s no competition. Imagine a Texas oil baron that owns 20 wells which will deplete over the next couple years. If they have more drilling sites available, they will drill. If they don’t, they will worry about where to put their retirement money - in a family office fund, the S&P500, maybe even renewables and cleantech projects all over the globe. Once the oil and gas is gone, I don’t think their top priority is to invest in something else on their own land, so this desire to amortize exactly like an oil well seems a bit weird. As far as investments go, Terraform is competing with every other asset class on this planet.

I suspect what may be going on here is that Terraform really dislikes the unit economics and timelines of traditional power-to-gas plants. I get why. A lot of these projects never see the light of day because they require massive financing, planning, permitting etc. and don’t get past the chicken-and-egg problem of supply and demand (a.k.a. “If we only had a plant, we could sign the offtake agreement.” / “If we only had an offtake agreement, we could build the plant.”). Terraform wants to be the antithesis to these projects, similar to what small modular reactors are trying (and failing) to accomplish in the nuclear space. The truth is that industrial plants have large economies of scale, so while it may be cumbersome and less sexy, building bigger plants gives you much better ROI, albeit with longer amortization periods.

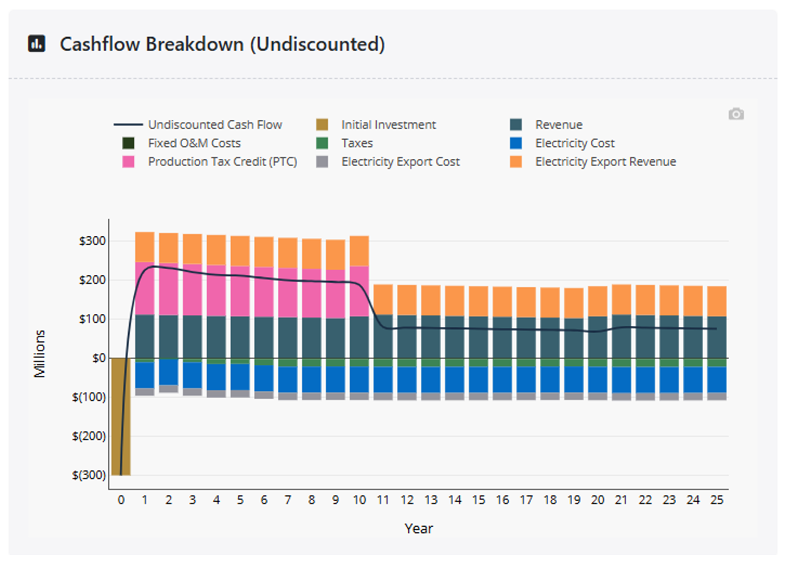

A nice example of how to realistically plan such a case is Verdagy’s “Techno-economics summary for a 400 MW electrolyzer plant in 2030”:

Source: Verdagy white paper on green hydrogen production

Source: Verdagy white paper on green hydrogen production

Note how it models all the relevant costs (including renewables, taxes, O&M etc.) and revenue streams (offtake, subsidies) over the entirety of a 25-year investment period.

Final Thoughts

Where does all this leave us? I am honestly a bit baffled by the outcome. When I started digging into the specifics of the Terraformer, I was intrigued by the boldness of the underlying hypotheses. Clearly, Casey and his team were on to something that everyone else was not (yet) seeing. I was convinced the value proposition would make sense and simply wanted to understand why and how. As I continued to dig, I kept hitting the same fundamental questions, but wasn’t finding answers: Why is the cost of renewable energy ignored? How would you amortize over 5 years when the solar array has a lifetime of 25 years? Why bet on low efficiency when you can get greater quantities of comparibly cheap hydrogen with higher-efficiency electrolyzers? Why base your unit economics on imaginary Henry Hub gas prices? Etc.

Many people in the cleantech space think that making synthetic hydrocarbons is a dumb idea. To quote Joe Romm, a physicist, climate researcher and green hydrogen expert that formerly led large-scale hydrogen programs at the DOE:

”[…] we’re going to take two waste products and try to convert them back into the original so we can burn them again. Okay, now if that isn’t clear, clearly one of the most inefficient last things you would ever do. And you’d never do it until you had so much excess renewables that you would solve every other problem first.”

Sidenote: You should listen to the entire podcast episode on the hydrogen hype, it’s quite eye-opening.

I am somewhere between Joe and Casey here. Yes, the first thing we should do is to continue to aggressively electrify everything. This is where deployment money (like the billions from the IRA) should go. More EVs, more heat pumps, more solar and wind, zero-carbon cement and steel etc. - these will decarbonize our primary energy use as quickly as possible. We will need tons of additional clean electricity for this and obviously this is where renewable energy should be used first (before more exotic downstream applications with poor end-to-end efficiency).

At the same time I agree with Casey when he points out that a huge portion of residential heating, especially in Europe, is based on natural gas and that it may take many decades to retrofit the housing stock with non-gas alternatives. Also, there are hard-to-abate sectors like aviation or shipping that will need huge amounts of synthetic fuels, like hydrogen, methanol or ammonia (synthetic kerosene seems like a bad idea we should not pursue).

So yes, we will need synthetic fuels and hydrocarbons and somebody should figure out how to make these cost-effectively, at scale. Rapidly declining solar costs and the eventual depletion of fossil fuels are factors that work in favor of this. All of that is correct in principle, but we are certainly not at the point where it is “cheaper to get carbon from the atmosphere than an oil well”. In its current form, the Terraformer is not “self-funding”, it is not a “gold mine” and with rising electrification and a gas industry that still has plenty of resources left in the earth’s crust, it is completly unclear whether unsubsidized synthetic natural gas will be able to compete on price … ever.

Terraform has a strong team with some of the most brilliant scientists and engineers. They are iterating fast and will solve/derisk a lot of the specific challenges around building low-cost, mass-manufactured power-to-gas plants. If they can somehow simultaneously make the Terraformer cheaper and significantly more efficient (to produce more hydrogen/methane), if solar panels will (again) break all learning curve estimates and decline in price even faster than expected and if, for some unpredictable reason, the natural gas price were to increase by a factor of 3-7x in the near future (and stay there), then - maybe - in 10 to 15 years the Terraformer might become an attractive investment that could have a meaningful impact on climate change. That’s a lot of big ifs, though.

PS: This blog post resulted from about a month of research. If you spot a mistake or believe that I have misconstrued something above, please let me know via the comments below and I am happy to update this post. If you enjoyed reading this, consider subscribing to future posts via the RSS feed below.