Sodium-Ion Batteries Won’t Free Us From Chinese Market Dominance

350 MW / 1,400 MWh of LFP capacity deployed in the Crimson Energy Storage Project.

350 MW / 1,400 MWh of LFP capacity deployed in the Crimson Energy Storage Project.

A recent deep dive led me into the land of battery energy storage systems and the role of sodium-ion batteries. I thought it would be worthwhile to share some of the things I learned here.

Why Batteries?

At this point, there is only one thing missing to solve the global green energy transition: Cheap, scalable storage. Solar and wind are the most economical, most abundant form of energy humanity has ever seen and they are being built out at an incredible pace. But their intermittency causes increasing market volatility (oversupply during the day, undersupply at night) and hinders the defossilization of industrial processes that require uninterrupted 24/7 power. Energy storage is the solution to both of these problems: It shifts supply to when it’s needed (“buy low, sell high”) and could eventually (with enough overcapacity buildout) turn solar and wind into “firm”, dispatchable sources of energy.

What, then, are our options for storing electrical energy for extended periods of time? The Future Cleantech Architects have a nice overview of long duration energy storage (LDES), which I have simplified here:

Four different types of energy storage deliver different storage durations. Adapted from Future Cleantech Architects

Four different types of energy storage deliver different storage durations. Adapted from Future Cleantech Architects

The four types of storage vary mostly by their duration.

Batteries are simple and efficient - electricity in, electricity out. They are perfect for storing a few hours worth of “intraday” energy.

Thermal storage uses renewable electricity to heat a “box of rocks”, molten salt or water in a tank. Stored heat is converted back to electricity by means of a heat engine, e.g. a steam turbine. With proper insulation, energy can be stored for up to several days.

Mechanical storage converts renewable electricity to potential energy, e.g. by pumping water up a hill or compressing air. It’s converted back to electricity using turbines or expanders. Energy can be stored for days or even weeks.

Chemical storage turns renewable electricity into a gas or liquid, e.g. green hydrogen, methane, ammonia or methanol. These can be stored in tanks or caverns for months and turned back into electricity using combustion engines or fuel cells.

When looking at intermittent solar power, we are mostly interested in intraday storage to buffer the diurnal energy supply of incoming photons. Batteries are a perfect match for this, as they offer high energy density (hundreds of Wh/kg), high efficiency (up to 95%), quick charging/discharging capability and decent lifespans (10-15 years). Their modularity also makes them attractive for colocation with varying sizes of solar farms (from small kWh projects to hundreds of MWh, see photo above). The market for battery energy storage systems (BESS) is growing rapidly and comprises different commercial segments, battery chemistries and application scenarios, which we will briefly look at in the following.

The BESS Market

In principle the demand side of the battery energy storage market is simple and consists of only three segments:

Utility: These are the so-called “front of the meter” (FTM) folks that generate and distribute renewable electricity. Think energy companies, grid operators and renewable developers.

Commercial & industrial (C&I): These parties consume energy “behind the meter” (BTM) to run commercial buildings or factories. Think shopping malls, hospitals and assembly lines.

Residential: These customers are also “behind the meter” (BTM) and represent the fragmented energy use of private homes. Think home owners with rooftop solar, heat pumps and EVs.

Notably, both BTM segments (C&I and residential) also produce increasing amounts of energy themselves, mostly for their own consumption and occasionally to sell back to the grid.

The motivation for adding BESS varies by segment. Utilities mostly want to increase flexibility and revenue, e.g. by improving grid stability, auctioning spare capacity, arbitraging spot prices or avoiding costly grid updates. C&I entities mainly want to be resilient to outages and drive down operating costs. Residential parties want to lower the cost of home energy use (ideally to zero) and - solar conditions permitting - become independent of the grid.

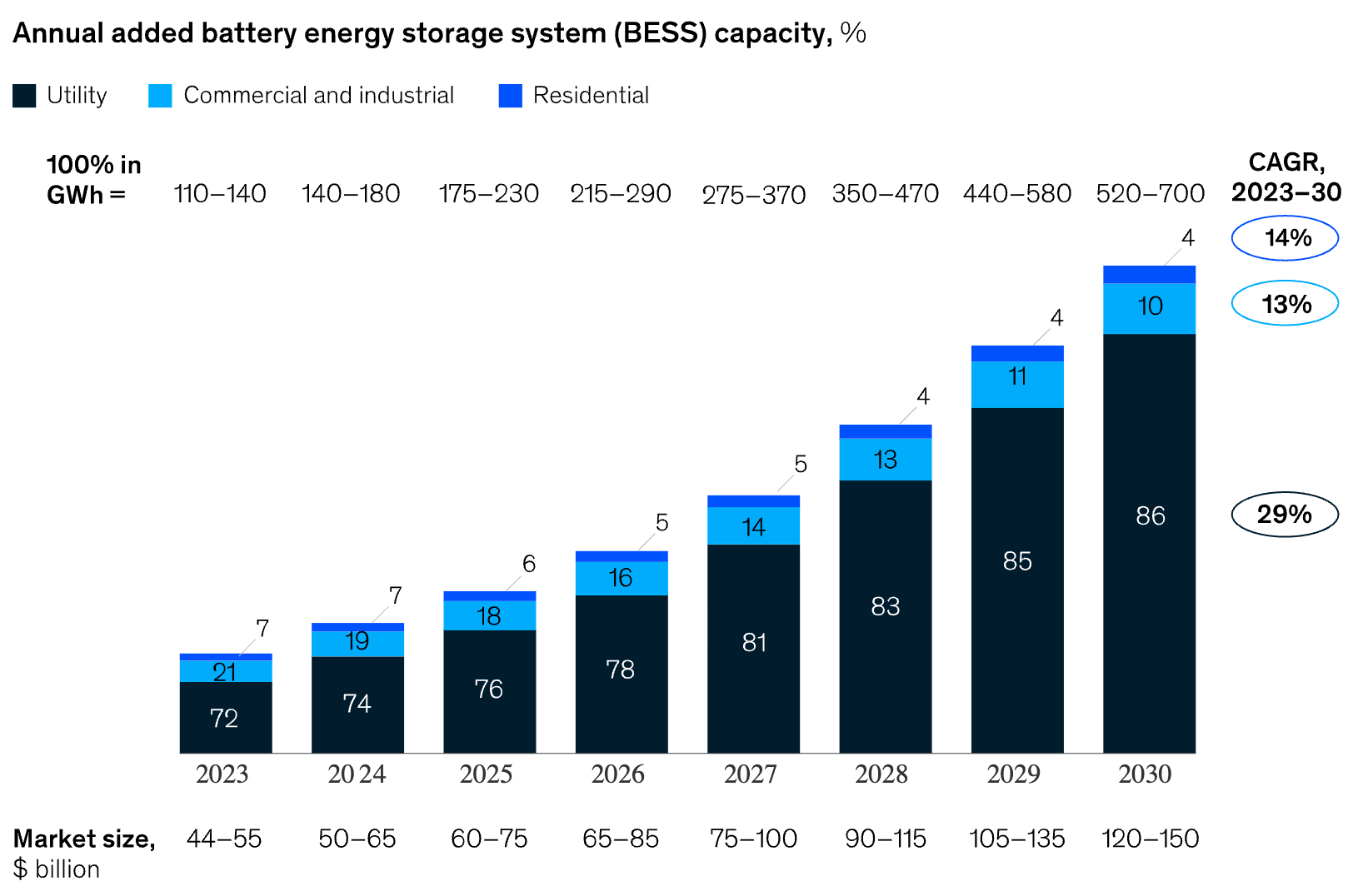

McKinsey created a nice breakdown of the C&I subsegments in a 2023 report, in case you’re interested. The same report also gives a good indication of the overall market size and its projected growth:

Source: McKinsey, Enabling renewable energy with BESS

Source: McKinsey, Enabling renewable energy with BESS

As expected, the largest chunk by far is the utility sector, both in terms of overall size and growth rate. $100-130bn by 2030 with 30% compound annual growth is nothing to sneeze at. C&I takes an attractive second place with $12-15bn by 2030 and 13% YoY growth. Though residential is a big market in terms of the number of customers, its overall size is essentially negligible.

Battery Chemistries

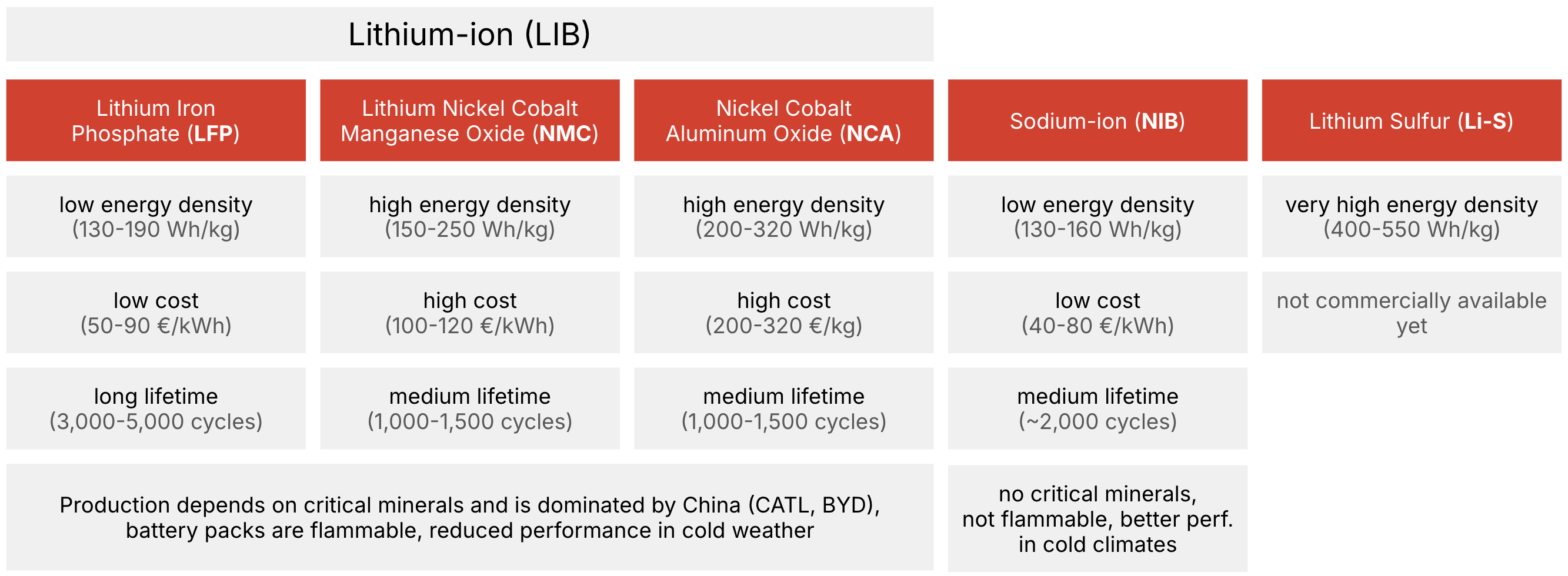

The battery types used for BESS depend almost exclusively on advancements in the EV sector, which, through its massive economies of scale, drives R&D and manufacturing capacity. The dominant cell chemistry for BESS are lithium-ion batteries (LIB):

Nickel cobalt aluminum oxide (NCA) batteries offer the highest energy density available today and are used in high-performance applications (drones, performance EVs). They have a comparatively high price per kWh and medium lifetime.

Lithium nickel cobalt manganese oxide (NMC) is the most common battery chemistry. It has a high energy density, lower cost than NCA and medium lifetime.

Lithium iron phosphate (LFP) cells have gained significant market share in recent years. Their lower energy density is sufficient for many applications including EVs and they make up for it in lower cost and longer lifetime.

There is an ongoing arms race to find new, even better-performing lithium-based chemistries. The most promising is currently lithium sulfur (Li-S), which has significantly higher energy density and will (once mass-produced) have lower cost than existing cell types. However, Li-S batteries are not commercially available yet.

All the aforementioned chemistries rely on critical minerals like lithium, nickel and cobalt. They can be found and mined in only a handful of countries, namely China, Australia, Canada, Chile and Argentina. Europe is facing active opposition to start mining its only lithium reserve in Serbia.

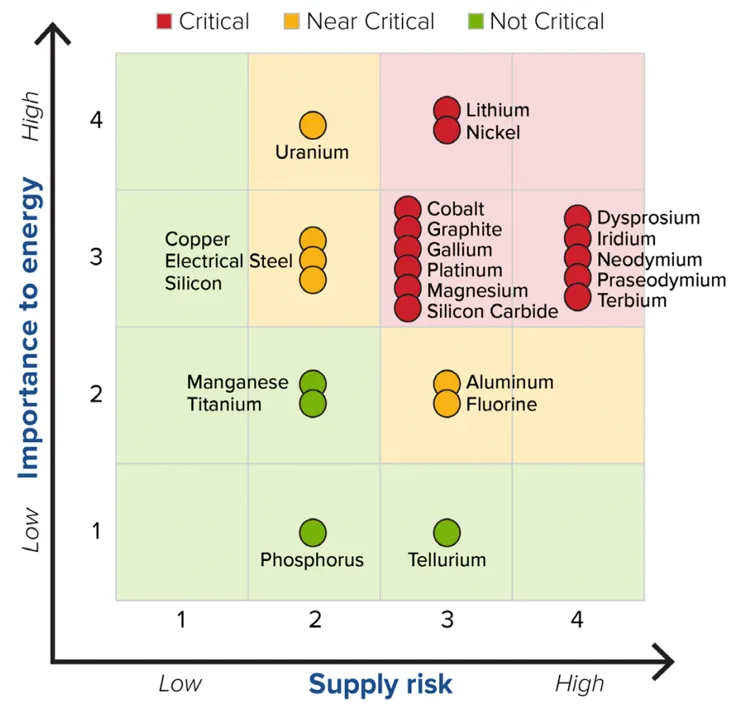

The minerals are “critical” both from a supply chain standpoint (they are hard to come by) as well as a technology standpoint (they are essential for building next-gen tech). In the context of the global energy transition, considerations of energy autonomy and national security also come into play. The Center for Sustainable Systems at the University of Michigan made a useful overview as part of their Critical Materials Factsheet:

Source: University of Michigan, Critical Materials Factsheet

Source: University of Michigan, Critical Materials Factsheet

As you can see, most materials needed for lithium-ion batteries are in the red category (high supply risk, high importance to energy). Unsurprisingly, for several decades researchers have been trying to find chemistries with comparable performance but no dependence on critical minerals. Many prototype chemistries are being experimented with, but the only commercially viable chemistry to date has proven to be sodium-ion (NIB).

Sodium (Na) metal (Photo by Dnn87 / Wikipedia, CC BY-SA 3.0)

Sodium (Na) metal (Photo by Dnn87 / Wikipedia, CC BY-SA 3.0)

Sodium is the 6th most abundant material in the earth’s crust and can be mined almost anywhere. It is less energy dense (on the low end of LFP batteries), but also signficantly cheaper and has a decent lifespan. Apart from its supply chain benefits, two other significant advantages of NIBs are that they are nonflammable and have better performance in cold conditions.

I made a small comparison chart to put the main chemistries in perspective (feel free to zoom in):

Note that there are other chemistries and technologies that I haven’t included here, like nickel zinc (Ni-Zn), solid-state, metal-air and redox flow batteries.

BESS Makers

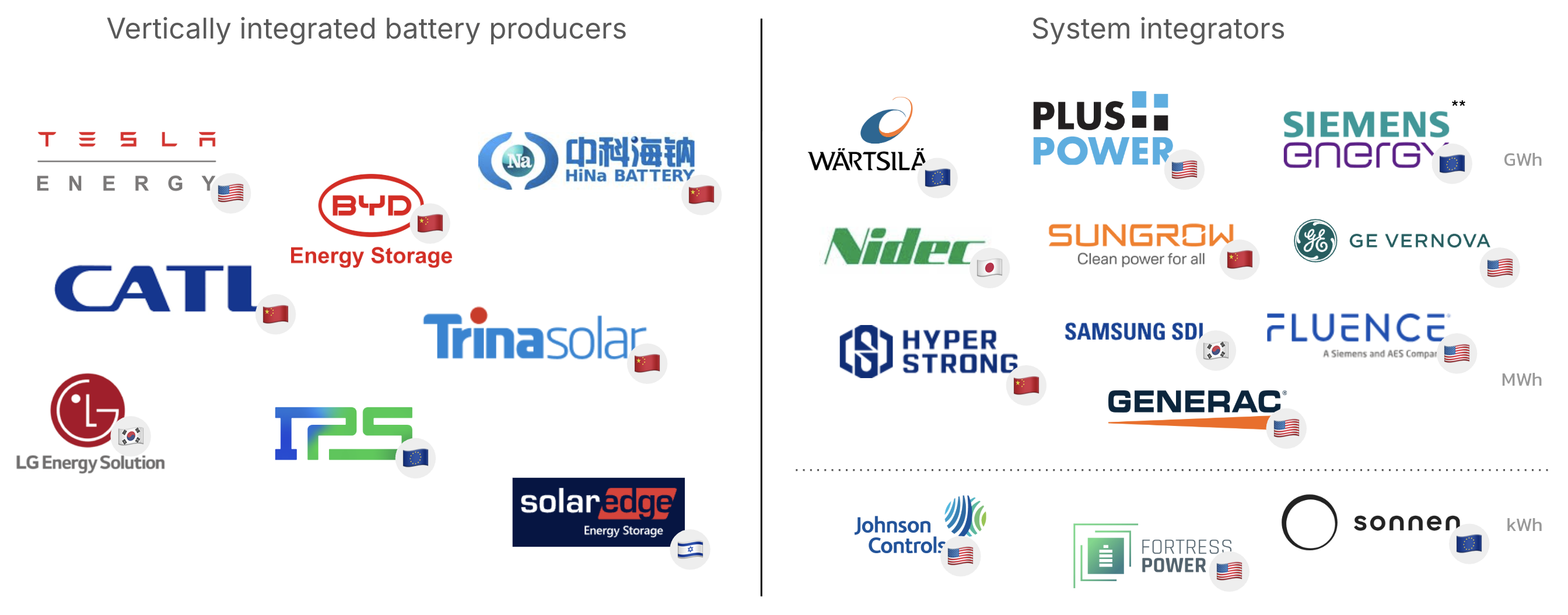

OK, so we know why battery energy storage systems are important, who uses them and what ingredients are needed to make them. But who makes them? It turns out the supply side is even simpler than the demand side, as there are only two types of players:

Vertically integrated battery producers own the whole value chain. They start at the cell level (designing and/or producing the battery cells), assemble cells into battery packs, interconnect the packs, add low-level control electronics and put the components into modular containers. This makes up roughly 50% of the value chain. They then continue with the steps outlined below, all the way to delivering the finished battery storage system to the customer.

System integrators start further down the value chain. They buy containerized modules from battery manufacturers and combine them into smart, custom-built systems, adding power electronics, energy management and grid optimization software. There is a fair bit of engineering involved in this, which adds another 30% of the total value. The finished BESS product is then marketed and sold to customers, often in 20’ or 40’ containers. Utility-scale projects have some overhead for project development and bespoke design of the overall system. This last part, from marketing to installation of the final system, makes up 20% of the total value.

As one would expect, there is only handful of vertically integrated producers, most of them Chinese. There are many more system integrators, catering to different market segments. To give you a rough idea of the BESS producer landscape, I made the following chart:

A few notes:

Most vertically integrated producers do not actually make their own cells, but source them from an even smaller set of top-level Chinese providers (e.g. Tesla from CATL).

CATL, a chinese tech company founded in 2011, is the largest battery maker in the world with an incredible 38% global market share. They are followed by BYD, the chinese EV maker, which has captured 17% of the global battery market. Let that sink in for a moment: Statistically, every other battery in an EV or storage system is made by either CATL or BYD.

Bulgaria-based IPS (International Power Supply) is Europe’s most promising and (after the failure of Northvolt) only model child in the battery space. They currently own less than 10% of the European BESS market, but have some serious engineering and manufacturing chops. Fancy an insane 8.1 MWh in a 20’ container? Or how about a completely autonomous factory powered by renewables and their own BESS?

System integrators vary widely by their target market, from a few established power houses like European Wärtsilä or American Plus Power developing utility-scale, GWh-sized projects all the way down to hundreds of smaller players that build and install (often standardized) systems in the kWh range for C&I customers.

Chinese Sungrow is one of the biggest BESS integrators, with over 15% global market share.

Siemens Energy is also interesting: They don’t operate battery factories themselves, but probably could if they wanted to, as they provide essential manufacturing and automation capabilities to most of the big battery makers. In their role as system integrator they offer battery storage systems in the MWh range.

Panasonic, once a serious contender, has recenctly exited the BESS space.

Alright, that should do for an overview. What about the headline of this article?

The Promise of Sodium-Ion Batteries

Given the context from above, one thing should be crystal clear: China has risen to absolute dominance in the renewable and energy storage market. Not only are they leading the solar revolution by a wide margin, on track to build out 1 TW of solar PV capacity by the end of 2025 (yes, that’s terrawatt, as in 1,000,000,000,000 watts) and inundating the rest of the world with dirt-cheap solar panels. They have also fully captured the global battery market by virtue of a) sitting on top of most of the earth’s critical mineral supplies and b) having built up unparalleled manufacturing capacity and know-how over decades. And China is staying the course, having recently signed into law comprehensive legislation to further promote renewables and accelerate the country’s energy transition.

In principle, this is very good news: The second most populous country in the world is defossilizing its energy use at breakneck speed and is helping the rest of the world do so as well. Nonetheless, China’s dominance creates an imbalance in the global market and has governments around the globe worried they will end up completely dependent on Chinese resources, supply chains and technology going forward.

Needless to say, American and European policy makers (and their technological advisors) have been eying alternative battery chemistries for some time, first and foremost sodium-ion. European research projects on NIBs with exotic names like SIMBA, NAIMA and ENTISE have been underway for almost a decade. The European Commission has a Strategic Research and Innovation Agenda (SRIA) to ensure public funding for battery development beyond 2030. The US DoE also opened up funding for NIB manufacturing in 2024.

The policy makers were joined by investors hungry for cleantech profits. The green energy transition is not only a necessity for us to survive as a species, but also a huge growth driver for the coming decades. Across all industry segments, cleantech companies saw an influx of capital in recent years, enabling them to derisk new technologies and scale the deployment of proven ones. Sodium-ion batteries were no exception and when the global lithium market hit a supply shortage in 2022, the stars seemed to finally align for NIB makers and more funding started to pour in. Several US and European startups announced they would soon commence factory production. The promise was clear:

Betting on sodium-ion seemed to allow scaleups from Europe and the US to suddenly break free from the Chinese battery monopoly, delivering safe and truly sustainable batteries that would power the green energy transition outside of Asia.

Source: Northvolt AB

Source: Northvolt AB

The most prominent NIB players in Europe and the US are/were:

Northvolt, the now bankrupt Swedish poster child of European battery innovation, was planning to mass-produce NIBs with 160 Wh/kg based on Prussian white cathodes developed and produced by technology partner Altris in Sandviken, Sweden. There were no committed timelines or capacities, but Altris’ Fennac (Prussian white) plant would have allowed for an annual production volume of about 1 GWh.

Altris, the Swedish NIB technology specialist, does not produce batteries themselves, but manufactures the cathode material Prussian white and licenses manufacturing IP to players like Northvolt (see above) and Volvo.

California-based Unigrid has received a grant and announced plans to build a pilot factory in San Diego, “producing MWh-scale quantities of sodium-ion battery cells annually”. While some specs have been revealed, there is no mention of the energy density of these cells.

French NIB company Tiamat has plans for a “Gigafactory” with an eventual 5 GWh annual production capacity by 2030. The last announcements are from spring 2024 and its unclear (to me) whether they are on track to open their first production line by the end of 2025. Its current cells have a density of 105 Wh/kg.

Natron Energy is the only US NIB company with an operational factory, a 600 MW (not MWh) facility in Holland, MI. It has developed its own electrode chemistry (Prussian blue) with excellent lifecycle and charge/discharge properties. However, the energy density of its cells is much lower than LIBs, meaning Natron’s battery packs are only suitable for specific use cases like power backup / UPS systems (a subsegment of C&I) and not for density-critical applications like EVs. It is unclear whether their packs could eventually be suitable for solar BESS.

AMTE Power was a British NIB manufacturer with plans to open a 1 GWh factory in Dundee, Scotland by 2026. Their sodium-ion cells achieved a density of up to 150 Wh/kg. Unfortunately, they went bankrupt in Dec 2023. Their assets have been bought up by Dutch solid-state battery tech company LionVolt.

Faradion is a UK-based NIB research company that licences IP to manufacturing partners. They have built prototype cells with an impressive 190 Wh/kg, but it is unclear (to me) what their partnership landscape and road to mass production looks like.

In addition to these dedicated NIB startups/scaleups, a few established technology companies are dabbling with sodium-ion in the context of research projects, e.g. VARTA and IBU-tec. New startups like Moonwatt (Netherlands) or Peak Energy (USA) have received funding and announced plans to advance sodium-ion based systems. None of these companies/projects are currently commercially operational.

Although some of the above-mentioned companies did not survive, it seems that in general, there is a healthy and growing ecosystem of (sodium-ion) battery makers in the US and Europe alike, right? Surely, this strengthens the supply chain resilience and energy autonomy of the Western world, right? … Right?

I don’t think so.

False Hopes

A couple reasons lead me to believe that sodium-ion will not bring about the great liberation of Western battery production.

Sodium-ion batteries are a niche market and mainly a hedge against rising lithium prices. The overwhelming majority of innovation and R&D is happening in lithium-based chemistries. This means that NIB companies will not get to see the economies of scale and the drastic learning curve improvements that Chinese battery makers have benefited from for decades. Different forecasts place the NIB market at an overall size between $1bn and $2bn in 2030. With the optimistic assumption that BESS will make up 60-70% of this market, that would make for a total addressable market of $600m - $1.4bn, a meager 1% of the total BESS market forecasted by McKinsey.

NIB scaleups are in a chicken-and-egg situation with regards to building out manufacturing capacity. Because there is (not yet) a huge market for NIB, they depend on subsidies and orders from a few big customers, who are themselves taking a high risk ordering from unproven manufacturers. If any of these customers get cold feet (as was the case when BMW canceled their €2bn order with Northvolt), this can kill the company.

Although sodium-ion frees challengers from supply chain dependence, it doesn’t really give them an edge over Chinese manufacturers. Even though lithium prices recovered after the 2022 supply shock, all major Chinese battery makers (CATL, BYD and HiNa) announced continued investments in sodium-ion manufacturing capacity. Chinese companies keep their eye on the ball and they can ramp up NIB mass production faster than any European or American scaleup can say “pilot factory”. Case in point, BYD casually broke ground on a new 30GWh(!) sodium-ion facility in Xuzhou in Jan 2024.

China is driving most of the BESS demand through domestic projects, which means that Chinese companies have a competitive advantage by catering to the biggest battery storage market in the world - both for general BESS projects as well as NIB. To date, the only large-scale sodium-ion BESS deployments (hundreds of MWh for power stations) have happened in China and they were realized by HiNa Battery. CATL and BYD are closely following suit. Chinese battery makers don’t just have more resources and manufacturing capacity, they also already have a better track record and more real-life experience when it comes to utility-scale projects.

Besides the established players, there is a whole ecosystem of Chinese sodium-ion battery companies waiting in the wings. Names you have likely never heard include ZOOLNASM 众钠能源, EVE 亿纬锂能, Lishen 力神电池, Great Power 鹏辉, Higee 海基, Cham Battery Technology 创明新能源 and many more. The ECO teardown blog has a nice overview of these (spreadsheet here). All this to say that competition in the NIB space will be every bit as fierce as it is in the lithium-ion sector. For every NIB scaleup Europe or the US is trying to nurture, there are probably 4-5 Chinese competitors looking to snatch market share and driving down prices.

Conclusion

In summary, sodium-ion batteries are relevant for a range of lower-density applications, including BESS, and they are here to stay. As with lithium-ion, the big Chinese players lead the charge (pun intended) and will continue to dominate the global market. This is not the end of the world for Europe or the US, as there is enough worlwide demand for BESS and plenty of value to be had on the system integration level (see above). Simultaneously, continuous investment in sodium-ion R&D and smaller-scale manufacturing capacity, like Altris’ Fennac plant, is a reasonable European hedge against supply chain or trade barrier market disruptions. Most battery makers are multi-chemistry already and could likely gradually phase in NIB production with domestically sourced Prussian white once supply and demand pick up.

PS: Thanks for tuning in! I occasionally do long-form write-ups on deep dive topics like this one. If you enjoyed reading it, consider subscribing to future posts via the RSS feed below. Also, feel free to let me know your thoughts via the comments below or on Mastodon and Bluesky.